Ichimoku Cloud Analysis 14.02.2017 (GBP/USD, GOLD)

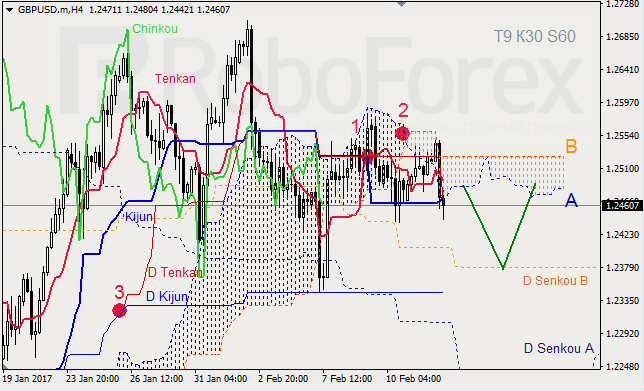

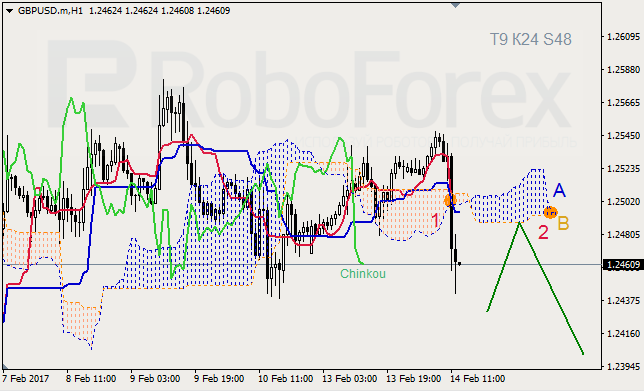

GBP USD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4. Indicator signals: Tenkan-Sen and Kijun-Sen are getting closer to each other, but still influenced by “Golden Cross” (1). Ichimoku Cloud is going down (2), Chinkou Lagging Span is on the chart. Short-term forecast: we can expect resistance from Senkou Span A and support from D Senkou Span B.

GBP USD, Time Frame H1. Indicator signals: Tenkan-Sen and Kijun-Sen ran into one another inside Kumo Cloud, they may intersect and form “Dead Cross” (1). Ichimoku Cloud is closed (2), Chinkou Lagging Span is below the chart, and the price is below the lines. Short-term forecast: we can expect decline of the price and the correction towards the cloud’s downside border.

XAU USD, “Gold vs US Dollar”

XAU USD, Time Frame H4. Indicator signals: Tenkan-Sen and Kijun-Sen intersected and formed “Dead Cross” (1), but they are still influenced by D “Golden Cross”. Ichimoku Cloud is moving upwards (2), Chinkou Lagging Span is on the chart, and the price is on Tenkan-Sen. Short‑term forecast: we can expect resistance from Kijun-Sen, and attempts of the price to fix inside the cloud.

RoboForex Analytical Department

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.