Murray Math Lines 12.04.2012 (EUR/GBP, AUD/JPY, USD/CHF)

12.04.2012

Analysis for April 12th, 2012

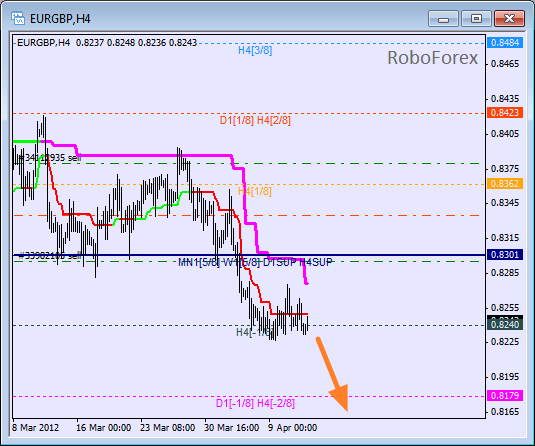

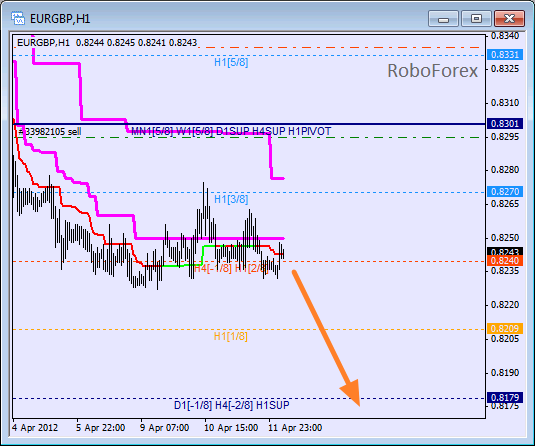

EUR/GBP

The EUR/GBP currency pair has been consolidating inside an “oversold zone” near the -1/8 level over the last several days. The chart structure indicates that the descending movement will continue. We can’t exclude a possibility that the price may break the -2/8 level in the nearest future, and the lines at the chart will be redrawn.

At the H1 chart the pair fixed itself below the 3/8 level. Currently the pair is consolidating, and this movement is supported by the Super Trends’ lines. Most likely, in the nearest future the descending trend will continue and the market will reach the 0/8 level or move even lower.

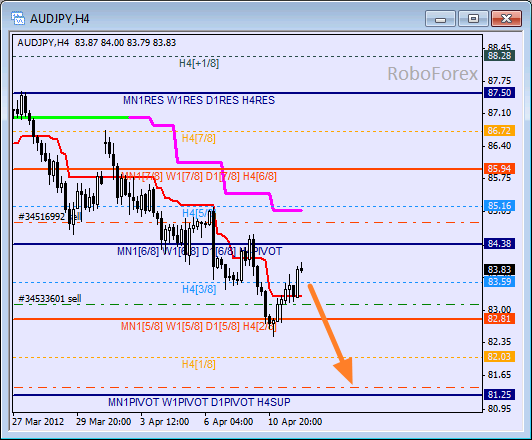

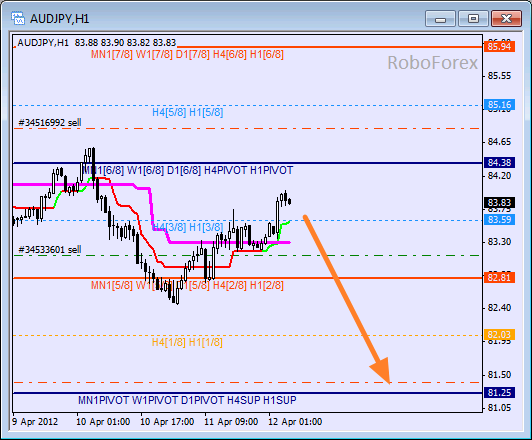

AUD/JPY

The correction started at the 2/8 level, the pair even broke the H4 Super Trend’s line. Most likely, the market won’t be able to stay at these levels for a long time and the price will start moving downwards again. The target for the bears for the next several days is the 0/8 level.

The lines at the H1 and the H4 charts are completely the same. Despite the fact that the corrective movement is quite active, the bulls might not be strong enough to continue pushing the price for a long time. In the near term, the price may continue falling down.

USD/CHF

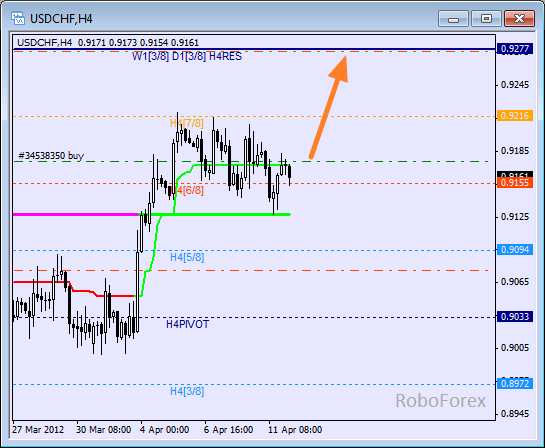

Earlier the price rebounded from the daily Super Trend’s line, thus indicating that the current up-trend may start again. The target for the bulls is the 8/8 level, and they may reach it within the next several days.

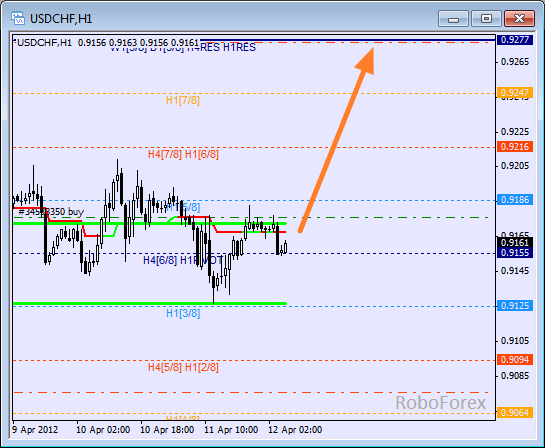

At the H1 chart the price tried to break the 4/8 level, but failed and continued moving above it. If Franc is able to fix itself above the 5/8 level, the price will continue growing up. The target in this case will be the 8/8 level.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.