Fibonacci Retracements Analysis 12.05.2021 (GBPUSD, EURJPY)

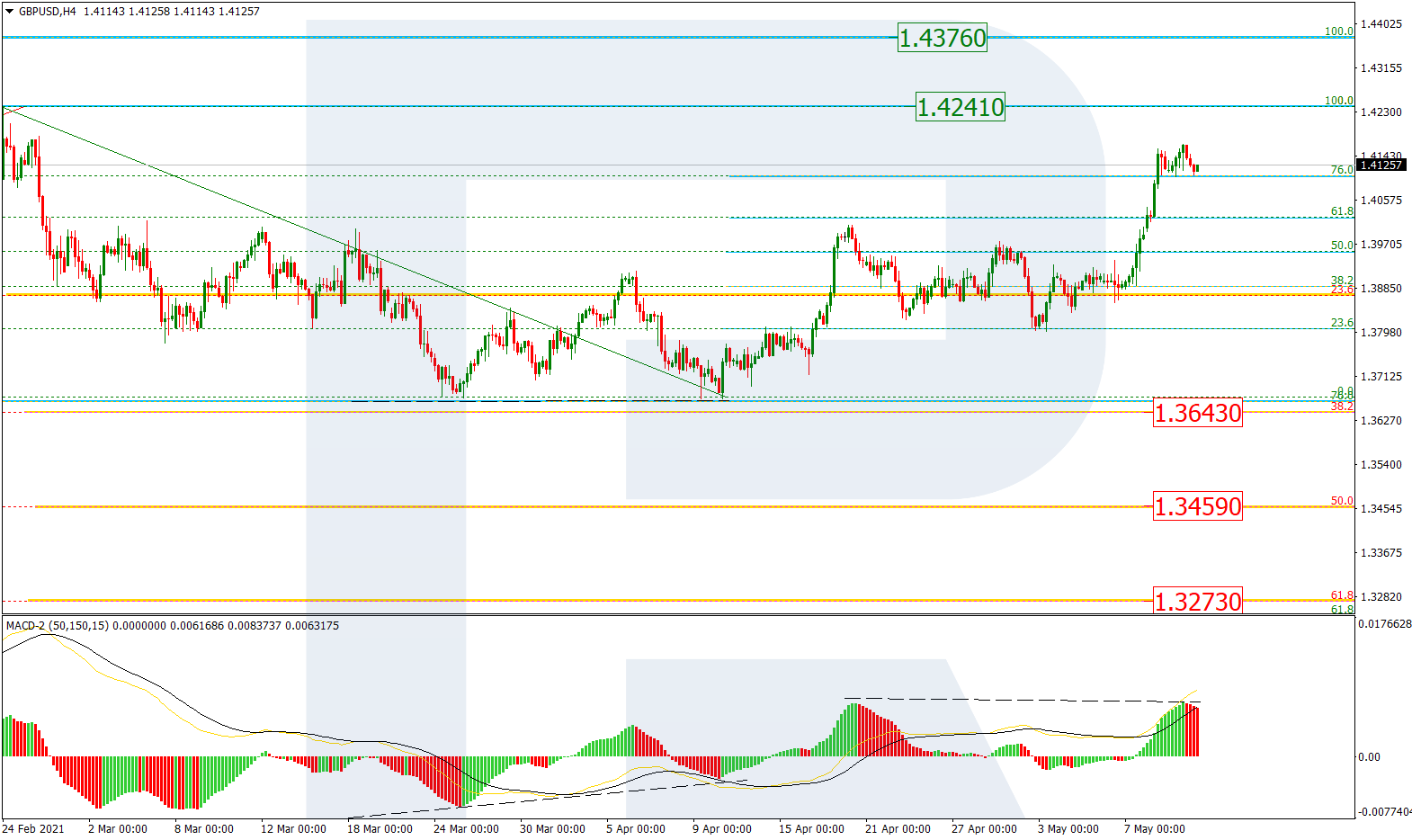

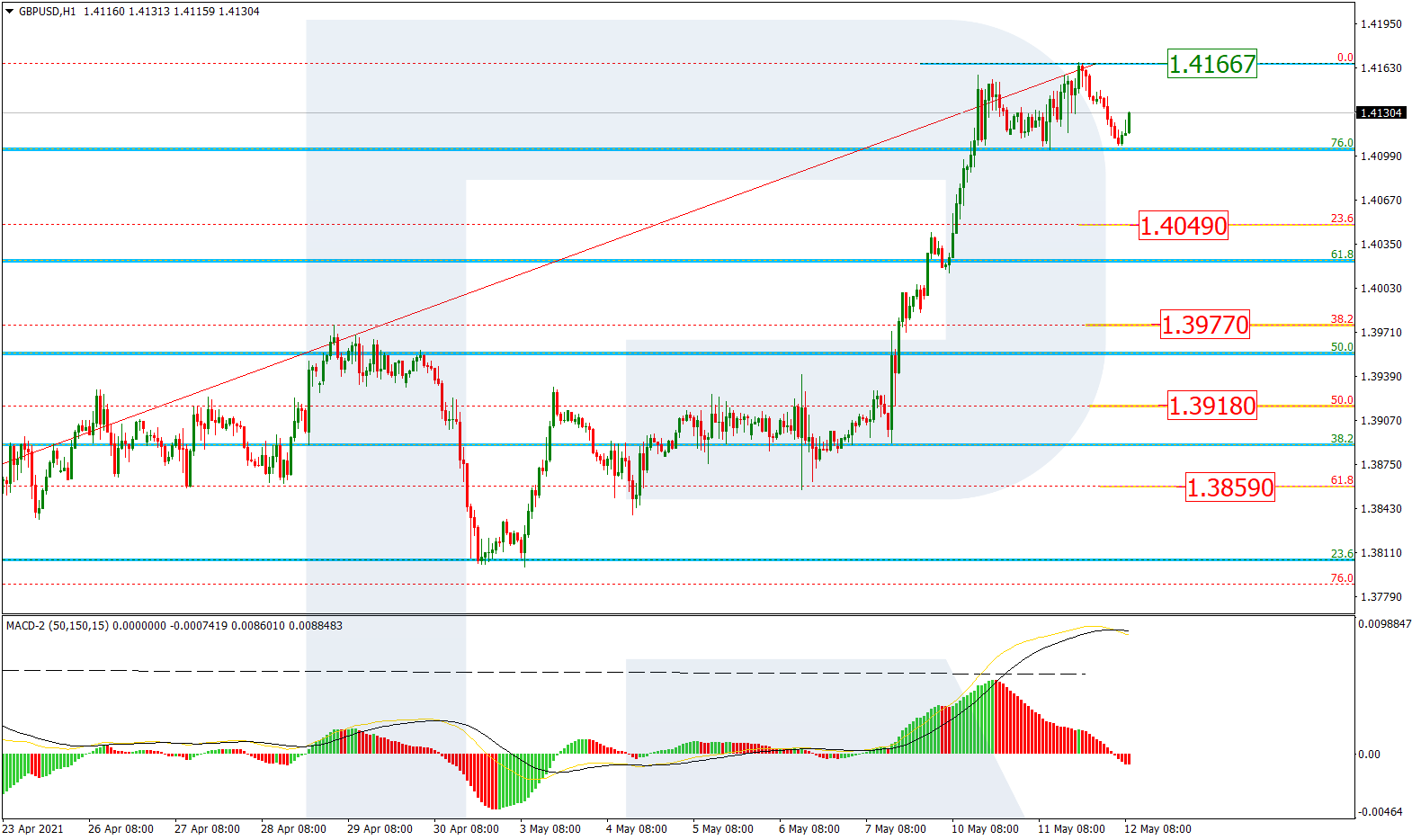

GBPUSD, “Great Britain Pound vs US Dollar”

In the H4 chart, after breaking its consolidation range to the upside, GBPUSD is forming a steady rising impulse, which may be heading to reach the local and key highs at 1.4241 and 1.4376 respectively. However, there might be another scenario implying a new descending wave, which is confirmed by a divergence on MACD. If it happens, the asset will continue falling to reach 38.2%, 50.0%, and 61.8% fibo at 1.3643, 1.3459, and 1.3273 respectively.

The H1 chart shows the short-term correctional targets after a divergence on MACD – 23.6%, 38.2%, 50.0%, and 61.8% fibo at 1.4049, 1.3977, 1.3918, and 1.3859 respectively. On the other hand, a breakout of the current high at 1.4166 will lead to a further uptrend.

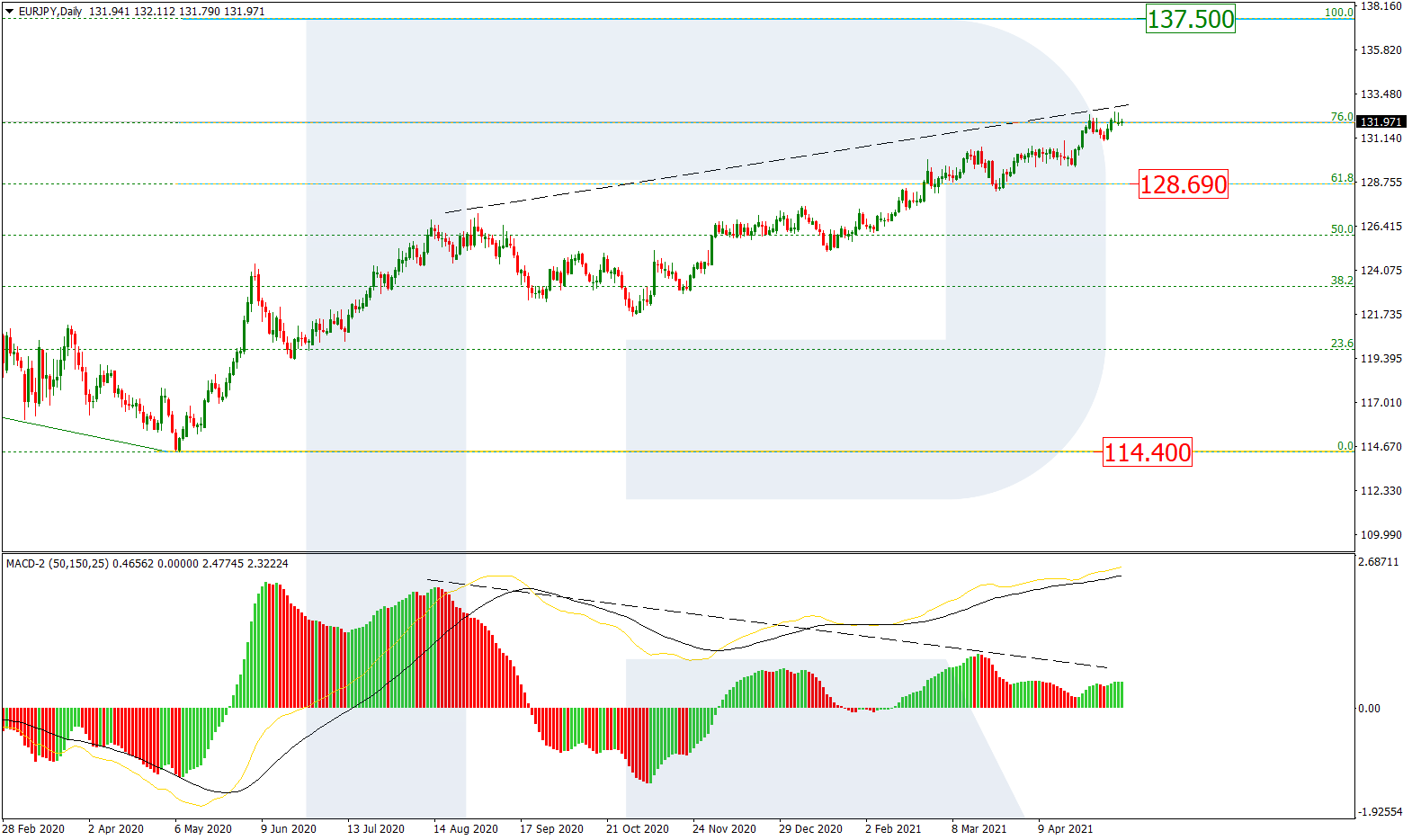

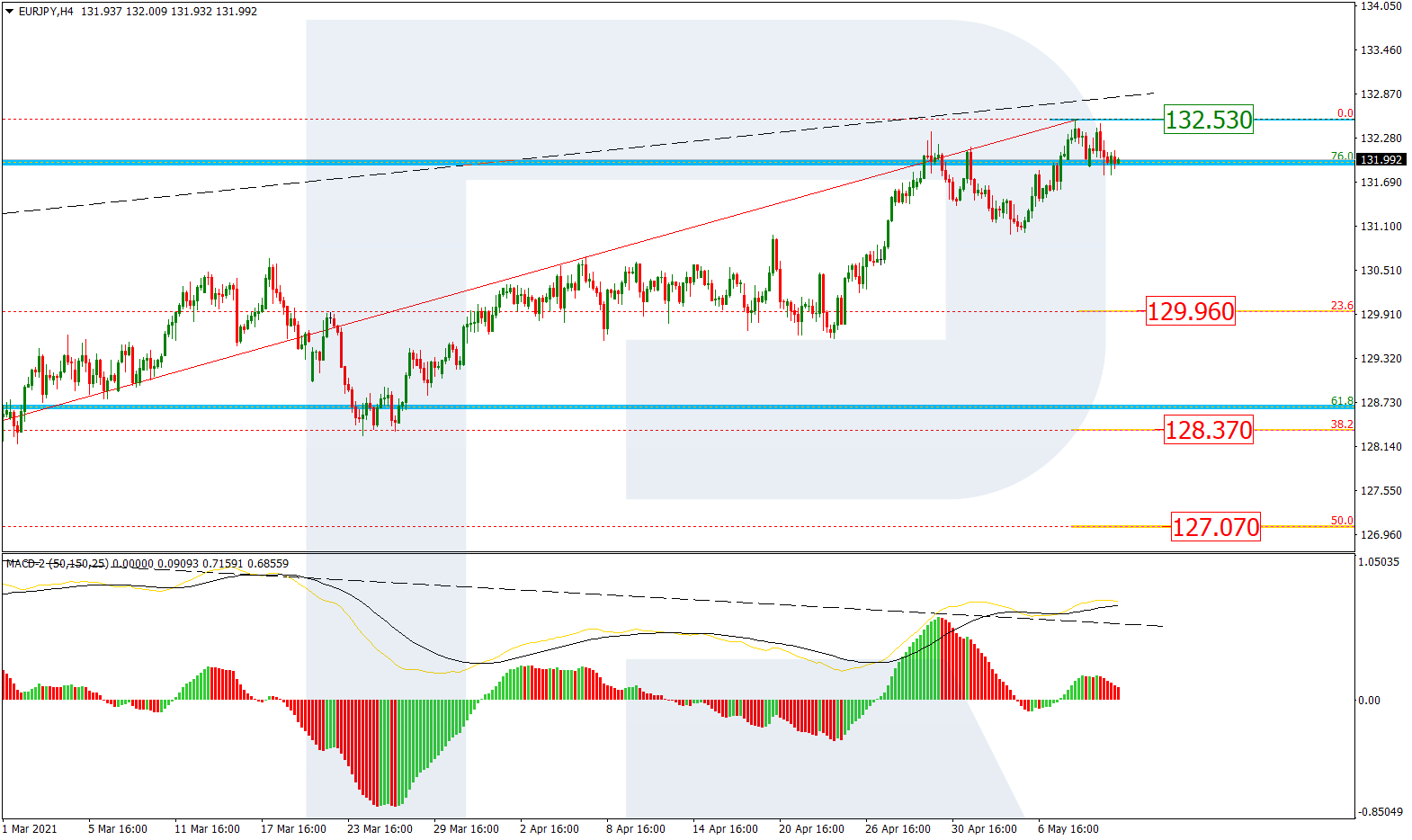

EURJPY, “Euro vs. Japanese Yen”

In the daily chart, EURJPY is still trading not far from the long-term 76.0% fibo. A further test of this level and a divergence on MACD may hint at a possible correctional decline soon with the short-term target at the support at 61.8% fibo (128.69). After finishing the correction, the instrument may form a new rising impulse towards the high at 137.50.

The H4 chart shows possible correctional targets after a divergence on MACD – 23.6%, 38.2%, and 50.0% fibo at 129.96, 128.37, and 127.07 respectively. The resistance is the high at 132.53.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.