Murrey Math Lines 01.12.2020 (AUDUSD, NZDUSD)

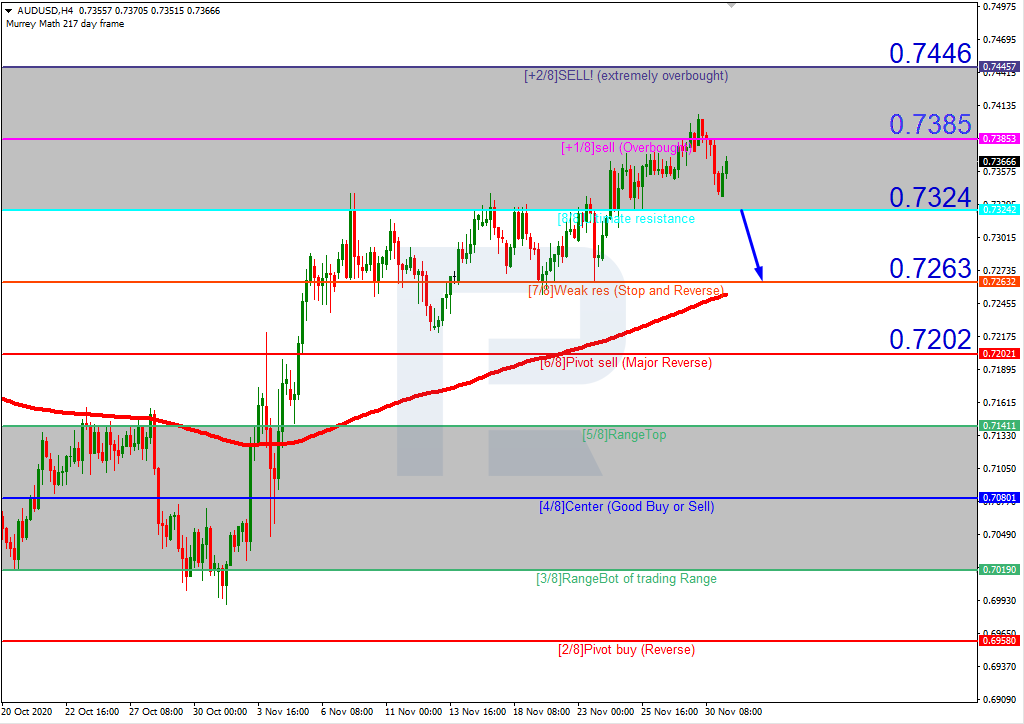

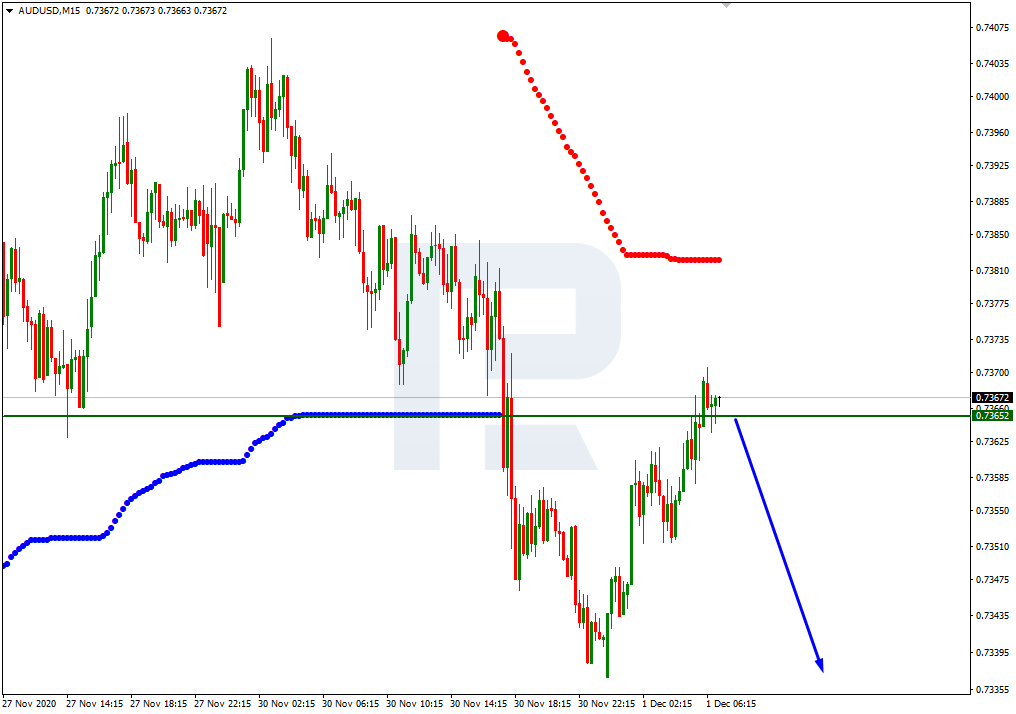

AUDUSD, “Australian Dollar vs US Dollar”

On H4, the quotations are trading above the 200-days Moving Average, suggesting an uptrend. However, the price is already in the overbought area. This means that a correctional decline is possible. The decline will be preceded by a breakaway of 8/8. The aim of the correction will be 7/8. The scenario will be canceled by a breakaway of +1/8, which might lead to furthe growth of the price to +2/8.

On M15, further growth of the price will be confirmed by a breakaway of the lower border of the VoltyChannel indicator.

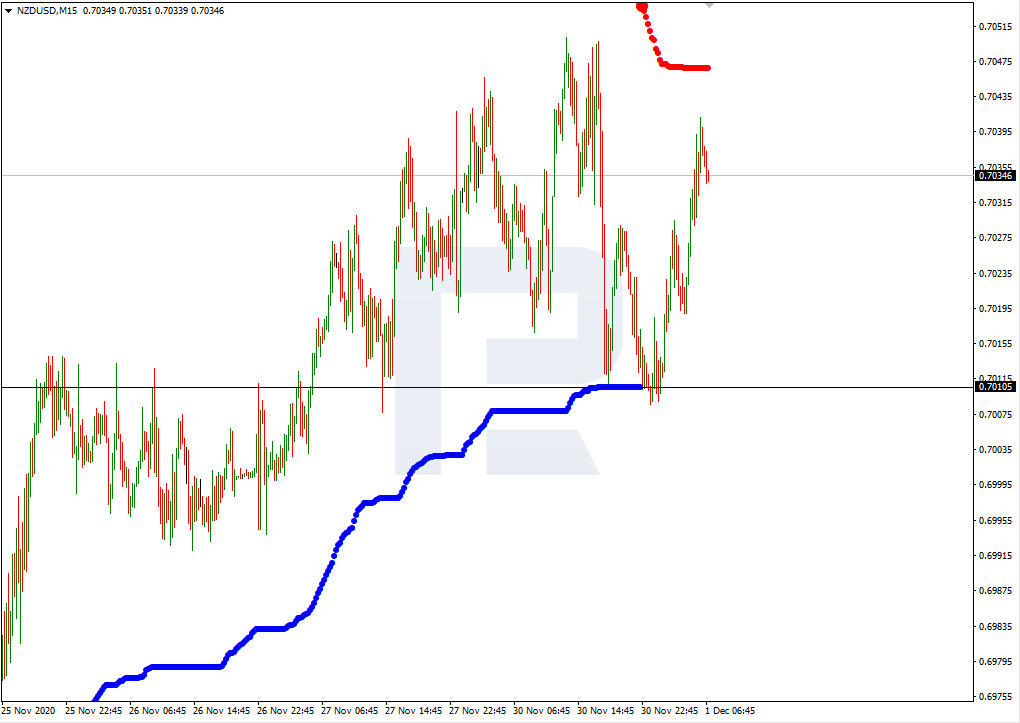

NZDUSD, “New Zealand Dollar vs US Dollar”

On H4, these quotations are also trading above the 200-days MA and in the overbought area. We expect the price to test +2/8, bounce off it, and fall to the support on +1/8. The scenario might be canceled by a breakaway of +2/8 – this will make the Murray indicator restructure itself, so that new goals will be set.

On M15, the lower line of VoltyChannel is too far away from the current price, so falling will only be signaled by a bounce off +2/8 on H4.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.