Fibonacci Retracements Analysis 17.06.2014 (EUR/USD, USD/CHF)

17.06.2014

Analysis for June 17th, 2014

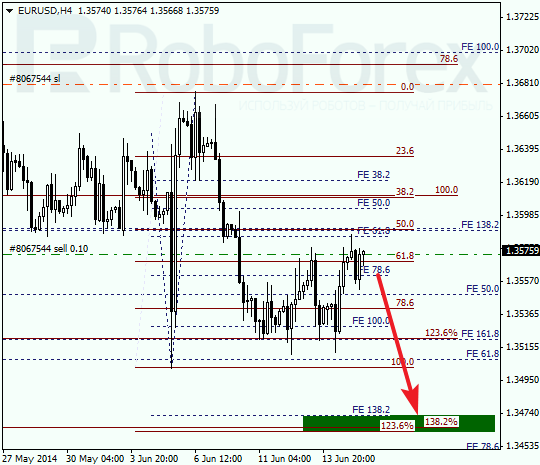

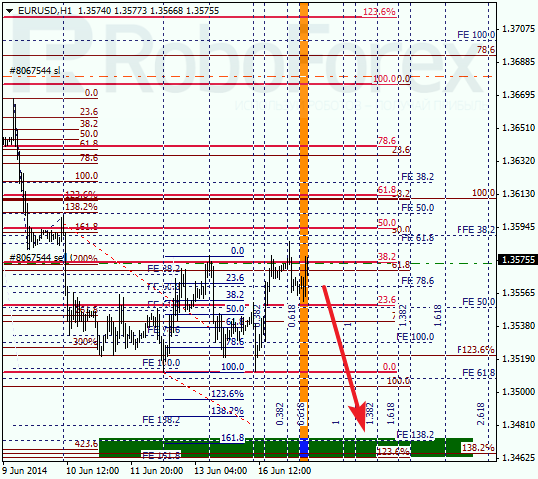

EUR USD, “Euro vs US Dollar”

EURUSD remains to stay possibly in correctional phase. 1.3470-1.3460 Fibo-congestion is still relevant. Recently short position was closed to breakeven and we have to search for a new entry point.

At H1 structure, local level of 38.2% is being tested. In case price pulls back from this level, it might be a signal for descending trend with further achievement of planned targets.

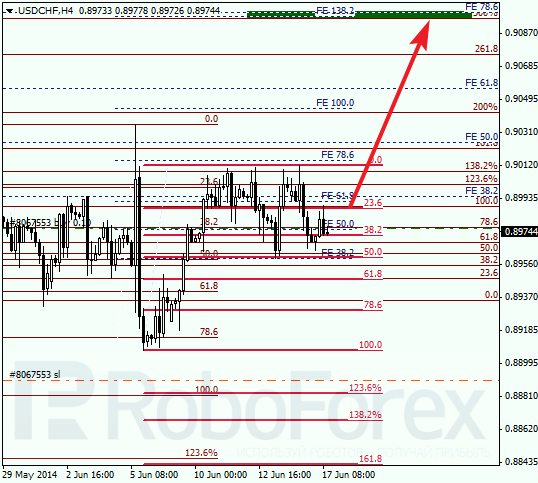

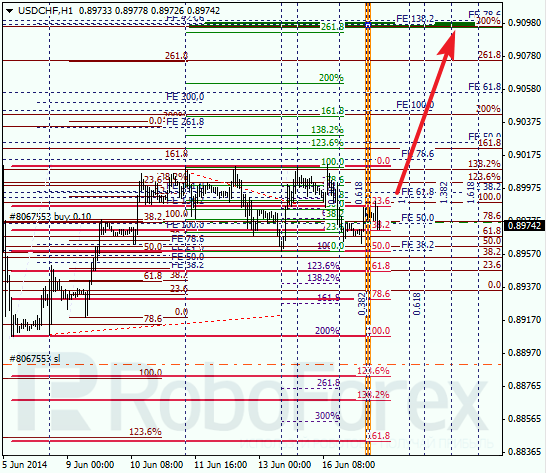

USD CHF, “US Dollar vs Swiss Franc”

USDCHF is also stays in correctional phase according to our models. It’s not excluded that sellers will push down price up to 50% retracement level. In case this level serves as a support, further growth to upper Fibo levels congestion (0.9100 – 0.9095) is possible.

At H1 chart upper targets are confirmed by some local levels (261,8% and 423,6% extensions), it makes this area stronger. If price will move higher, I will reduce risk for current position and place stop to breakeven.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.