Fibonacci Retracements Analysis 01.11.2013 (EUR/USD, USD/CHF)

01.11.2013

Analysis for November 1st, 2013

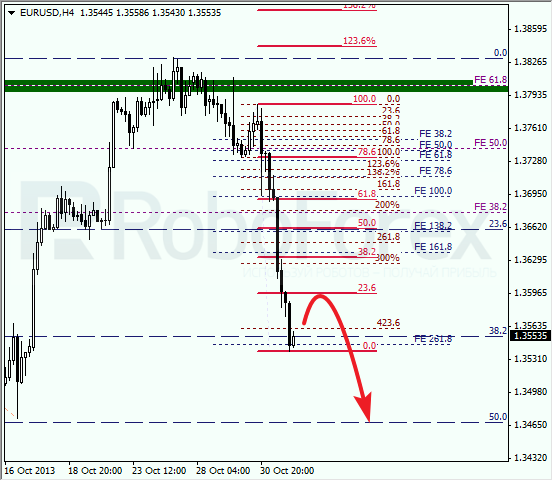

EUR/USD

Euro wasn’t able to stay above the level of 61.8% (fibo extension) and started moving downwards. The bears have already reached the intermediate target at the level of 38.2%. We can’t exclude a possibility that during the day the market may start the local correction, Later the price is expected to continue falling down towards the level of 50%.

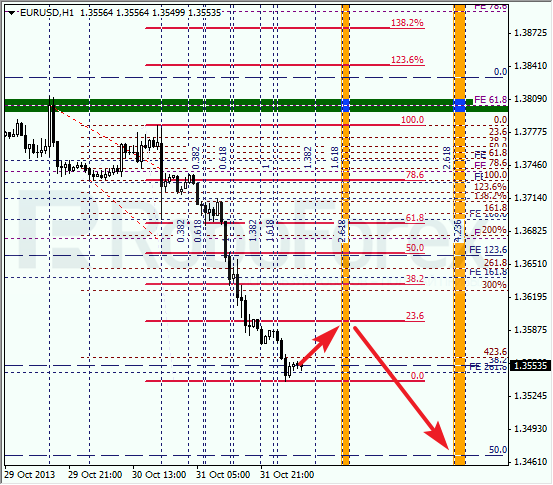

As we can see at the H1 chart, the price is starting a correction. According to the analysis of the temporary fibo-zones, the pair may complete this correction during the day. If later the pair rebounds from the level of 23.6%, the market may continue falling down.

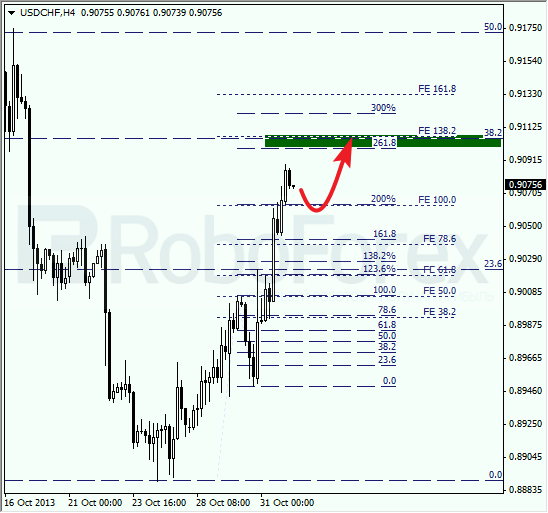

USD/CHF

In case of Franc, the main target is a bit closer. In the area of 0.91, we can see three fibo-levels, which may be a strong resistance for the bulls. Most likely, after a slight correction, the pair will continue moving towards the predicted targets.

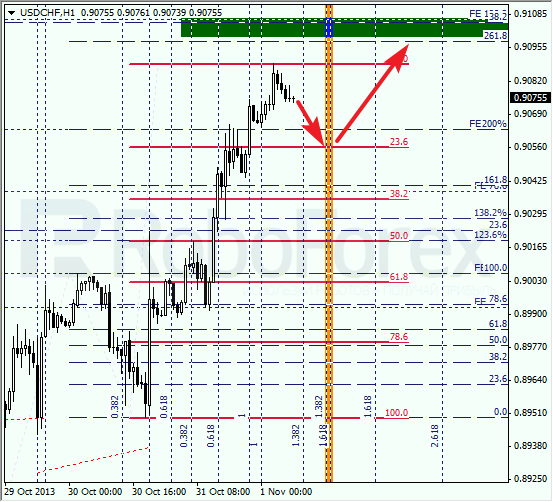

At the H1 chart, the target of the local correction is at the level of 23.6%. If the price rebounds from it, the pair will start a new ascending movement and I’ll open several buy orders.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.