Fibonacci Retracements Analysis 14.11.2014 (EUR/USD, USD/CHF)

14.11.2014

Analysis for November 14th, 2014

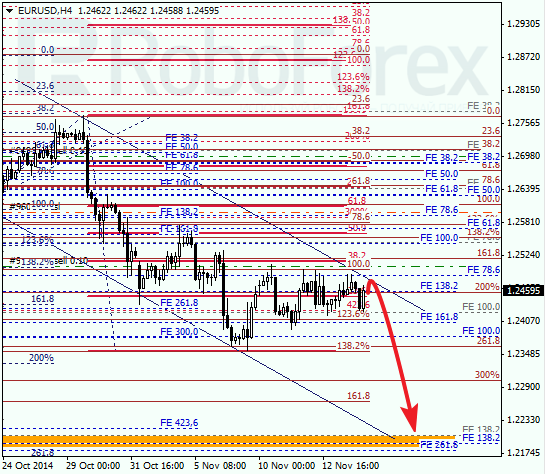

EUR USD, “Euro vs US Dollar”

Eurodollar is still being corrected; the market hasn’t been able to stay above retracement 38.2%, but we can’t rule out the possibility of testing the channel’s upper border. In the future, the price is expected to resume falling towards the group of lower fibo-levels.

At the H1 chart, flat continues. Earlier, the price was supported by several local retracements, which may be tested during the day. In the near term, in case the market rebounds from them, the pair may continue falling towards the group of lower fibo-levels at 1.2180 – 1.2200.

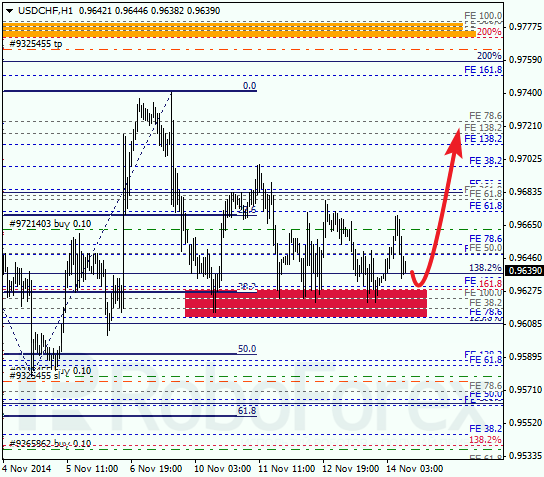

USD CHF, “US Dollar vs Swiss Franc”

It looks like Franc is going to test a local retracement 38.2% one more time. If bulls are able to rebound from it, the market may resume growing. The target is still the group of upper fibo-levels.

Probably, at the H1 chart the price is completing the current correction. Local retracements indicate that this correction may finish at retracement 38.2%. Possibly, the pair may resume moving upwards quite soon.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.