This website uses cookies

We use cookies to target and personalize content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising (including NextRoll Inc.) and analytics partners who may combine it with other information that you've provided to them and that they've collected from your use of their services. You consent to our cookies if you continue to use this website. Learn more

RoboForex

- Trading

- Accounts

- Markets

- MetaTrader 4

- MetaTrader 5

- R StocksTrader

- Deposits & Withdrawals

- Contract Specifications

Copy TradingPromotions- Welcome Bonus

- Leverage up to 1:2000

- Withdrawals at 0%

- Up to 10% on account balance

- Cashback (Rebates)

- Free VPS-Server

ToolsPartnersAbout usFibonacci Retracements Analysis 26.11.2014 (EUR/USD, USD/CHF)

26.11.2014Analysis for November 26th, 2014

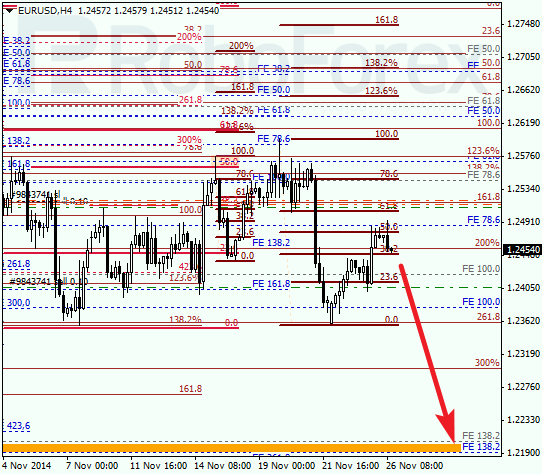

The price has rebounded from local retracement 50%, which means that the downtrend may resume. Earlier, Eurodollar rebounded from several local retracements and a correctional retracement 61.8%. The target is still the group of lower fibo-levels: after reaching them, the pair may start a new correction.

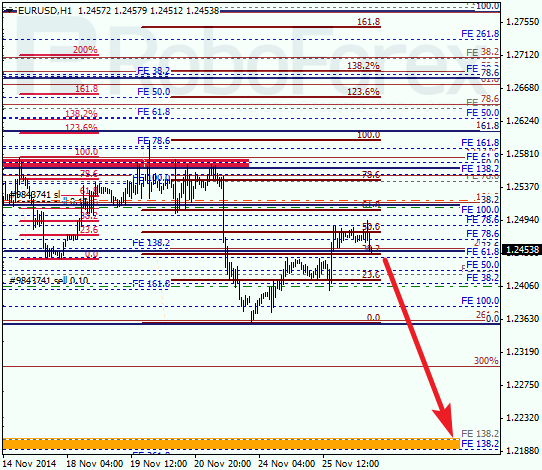

EUR USD, “Euro vs US Dollar”

As we can see at the H1 chart, bears have been supported by several local retracements, mainly by 50%. In the near term, the pair is expected to continue moving towards the group of lower fibo-levels at 1.2180 – 1.2200.

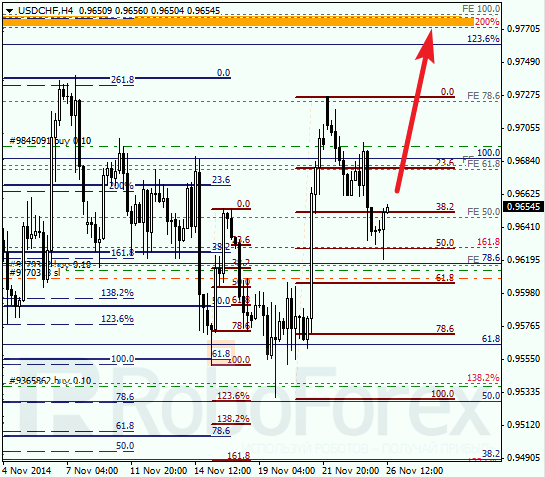

USD CHF, “US Dollar vs Swiss Franc”

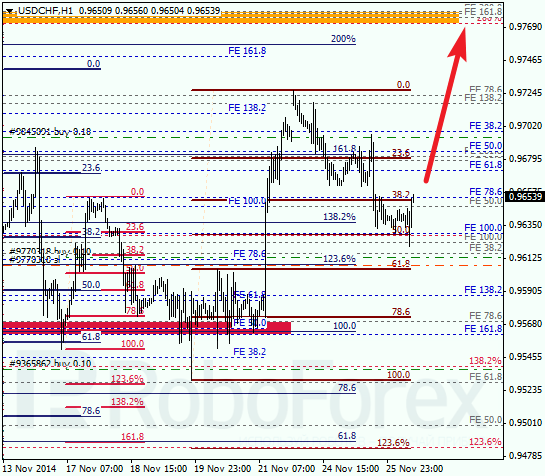

A rebound from a local retracement 50% may be a signal for Franc to resume moving upwards. The target is still the group of upper fibo-levels. The stop losses on my orders are still at a local maximum.

Possibly, the market may rebound from an intraday retracement 50% and start a new ascending movement. If the price continue growing, I’m planning to move the stop loss after the market. The pair may break the maximum during the next several hours.

RoboForex Analytical DepartmentAttention!Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.