Forex Technical Analysis 2012/02/02 (EUR/USD, USD/CHF, CAD/JPY) Forecast FX

01.02.2012

Forecast for February 2nd, 2012

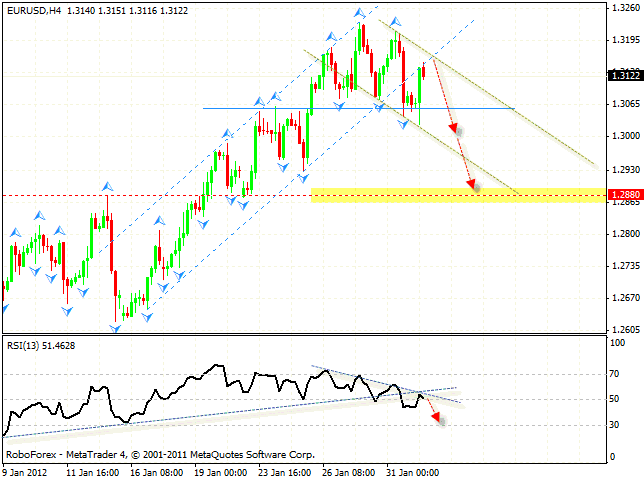

EUR/USD

After an unsuccessful test of the neckline, the EUR/USD currency pair has been corrected to the resistance line. One can consider selling Euro with the tight stop at the current prices. The closest target of the fall is the level of 1.3000, the next one is the test of the support level in the area of 1.2880. If the price returns to the broken trend’s line at the RSI, it will be an additional signal to sell the pair.

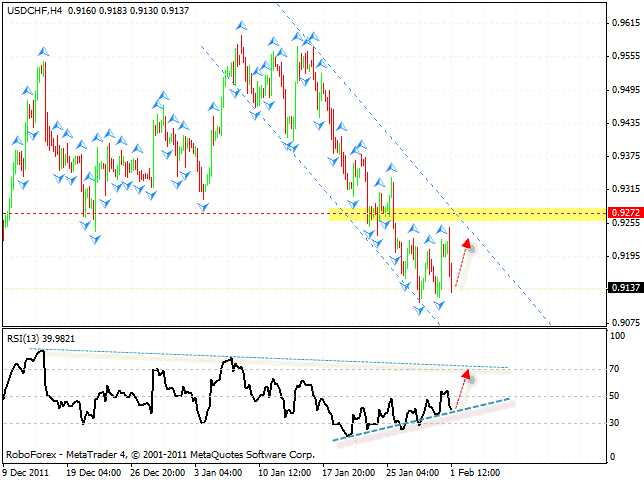

USD/CHF

Franc also tried to test local minimums. At the moment the RSI indicator was supported by the trend’s rising line at the RSI. The closest target of the growth is the descending channel’s upper border. At the RSI the resistance line is at the level of 70. One can consider buying the USD/CHF currency pair with the tight stop. If the price reaches new minimums, this case scenario will be cancelled.

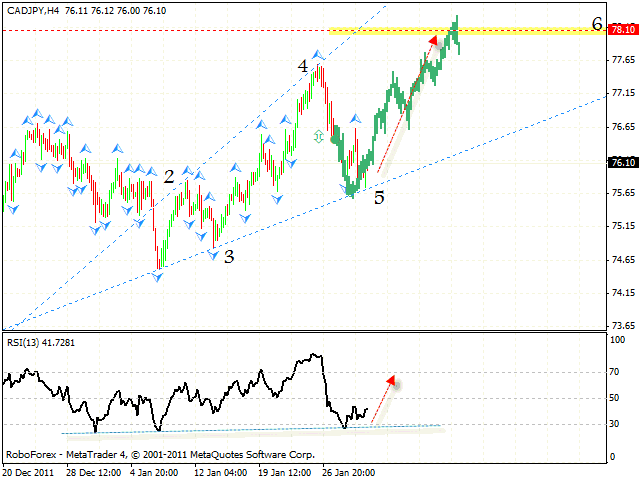

CAD/JPY

At the H4 chart of the CAD/JPY currency pair we can see the formation of the rising pattern with the target in the area of 78.10. At the moment the price is testing the trend’s rising line, one can consider buying the pair with the tight stop. The test of the trend’s rising line at the RSI is an additional signal to buy the pair. If the price breaks the trend’s line, this case scenario will be cancelled and we should expect the start of the descending trend.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.