Forex Technical Analysis & Forecast 25.01.2023

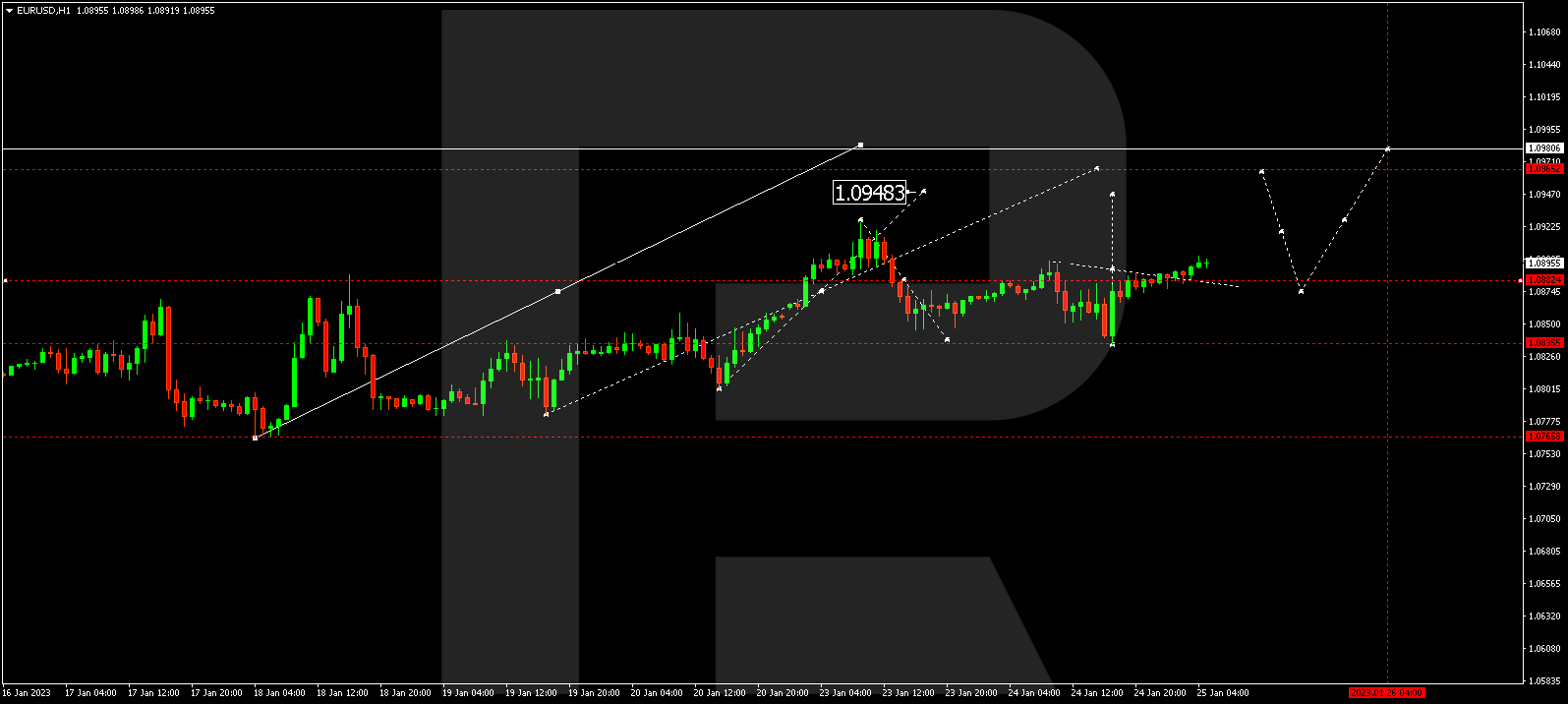

EURUSD, “Euro vs US Dollar”

The currency pair might demonstrate a structure of decline to 1.0835. Today the market has developed a structure of growth to 1.0892. At the moment, the market is forming a consolidation range around this level. With an escape upwards, the price might leap up to 1.0940. With an escape downwards, the wave of growth might continue to 1.0760.

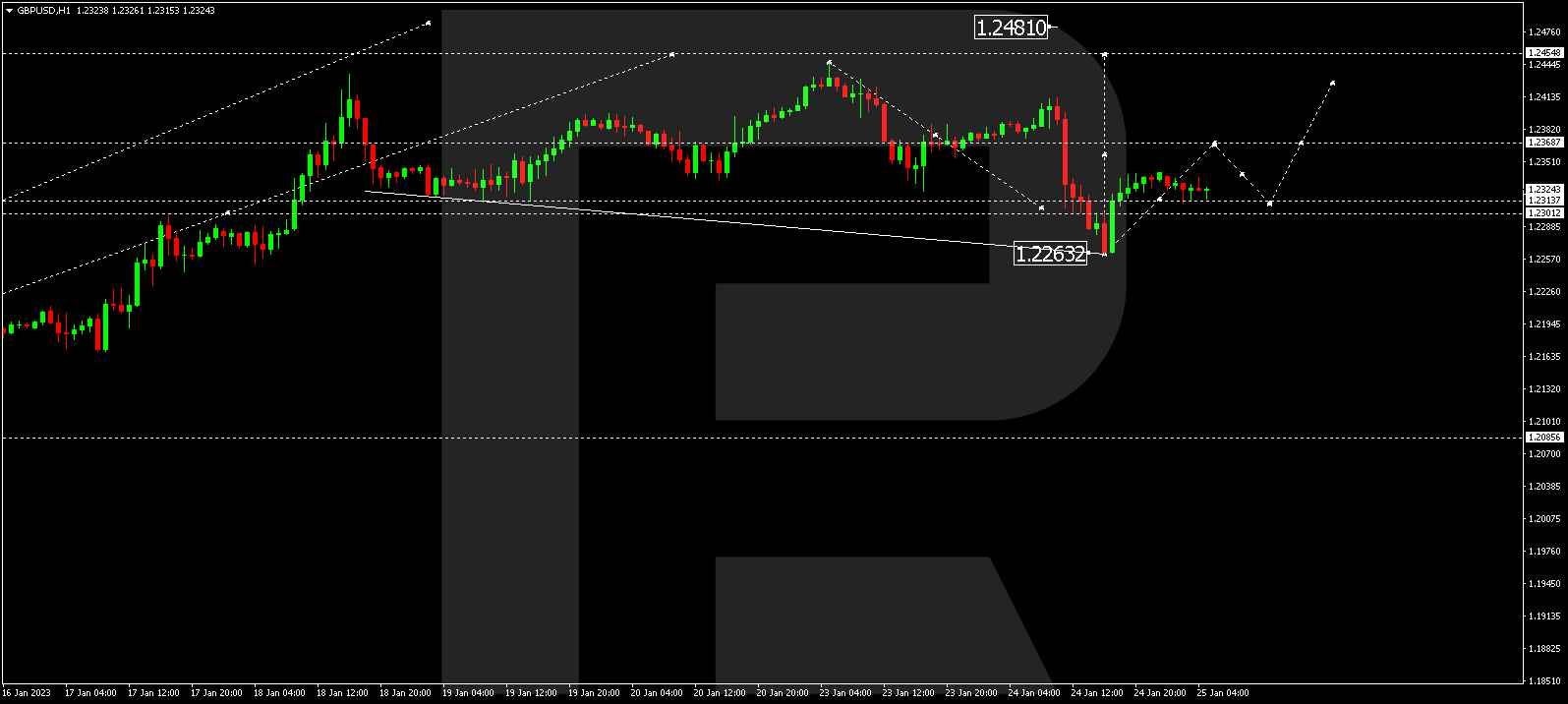

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has performed a new structure of decline to 1.2263. Today the market has developed an impulse of growth to 1.2313. At the moment, the market is forming a consolidation range around this level. With an escape upwards, a structure of growth to 1.2368 may form, from where the wave might develop to 1.2455. With an escape downwards, a pathway for a wave of decline to 1.2085 will open.

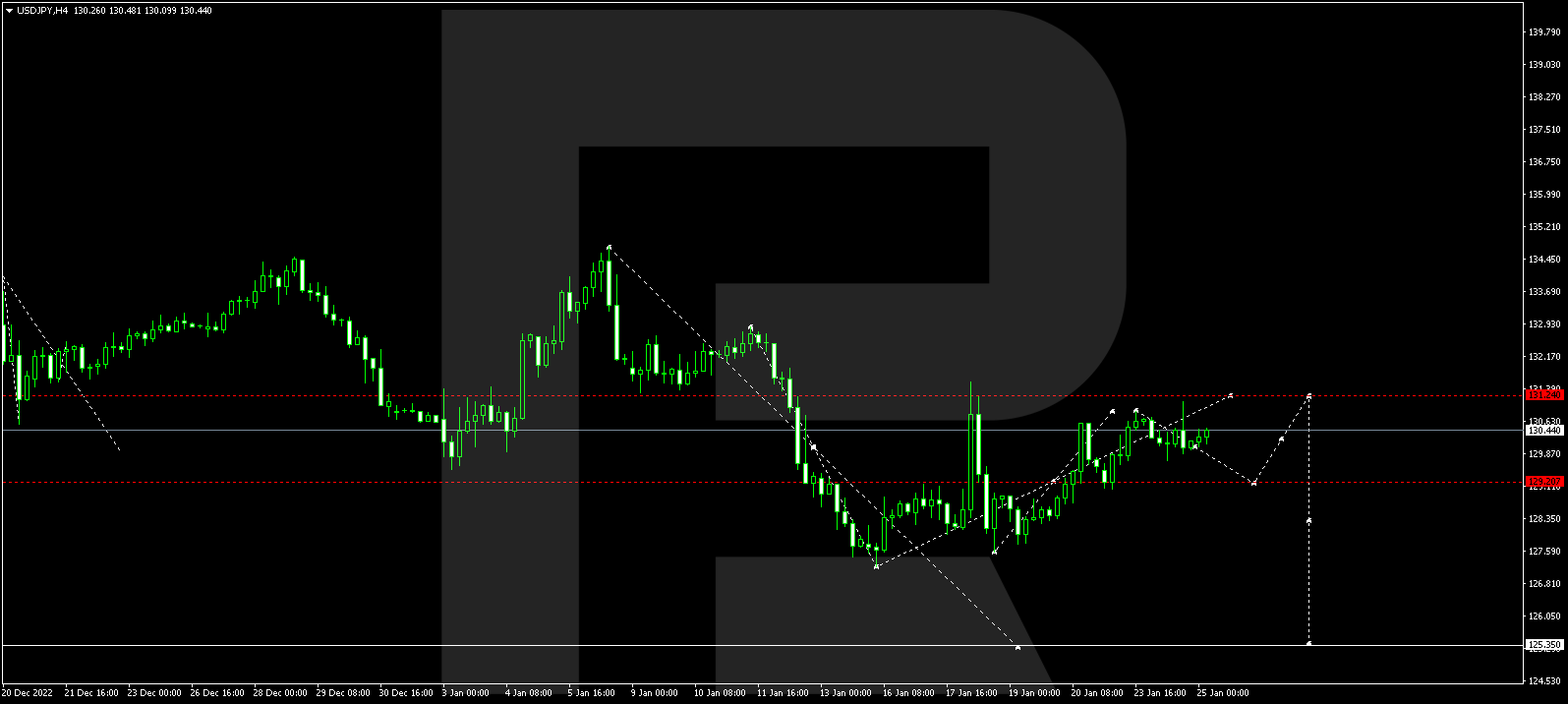

USDJPY, “US Dollar vs Japanese Yen”

The currency pair continues developing a consolidation range around 130.00. The range today might extend to 131.24. Then a wave of decline to 125.35 might start.

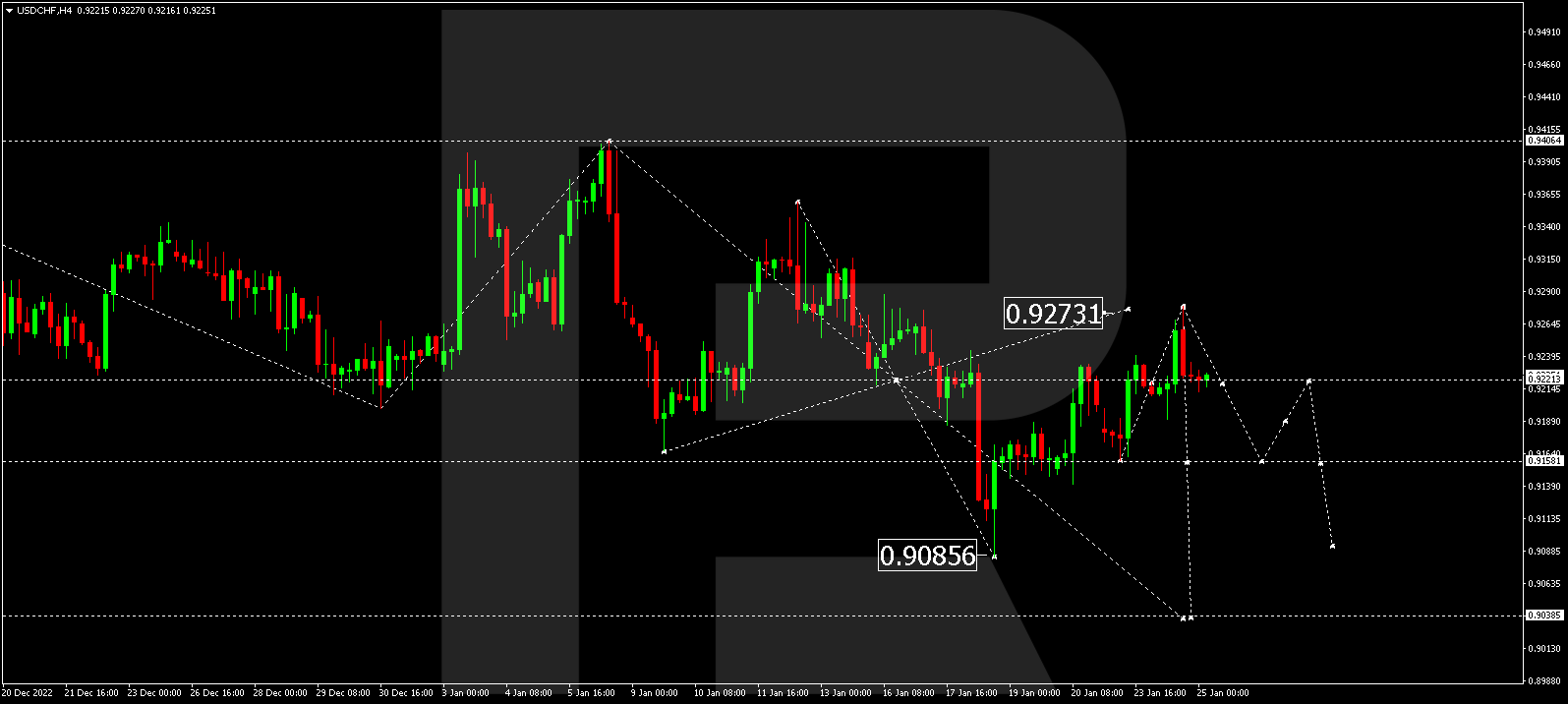

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has performed a link of growth to 0.9273. Today a wave of decline to 0.9040 might start, and then growth to 0.9400 should follow.

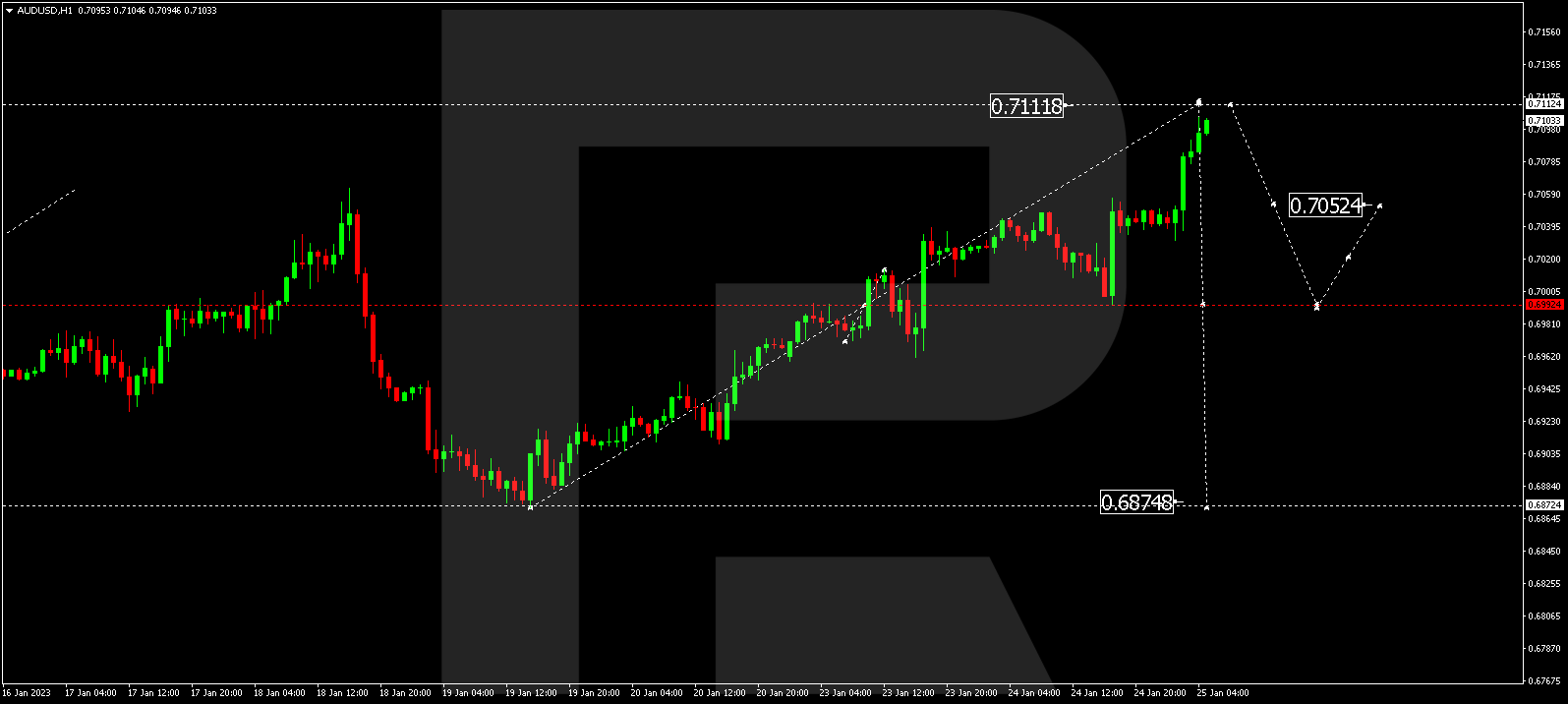

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair continues developing a wave of growth to 0.7111. After this level is reached,a wave of decline to 0.6875 should start.

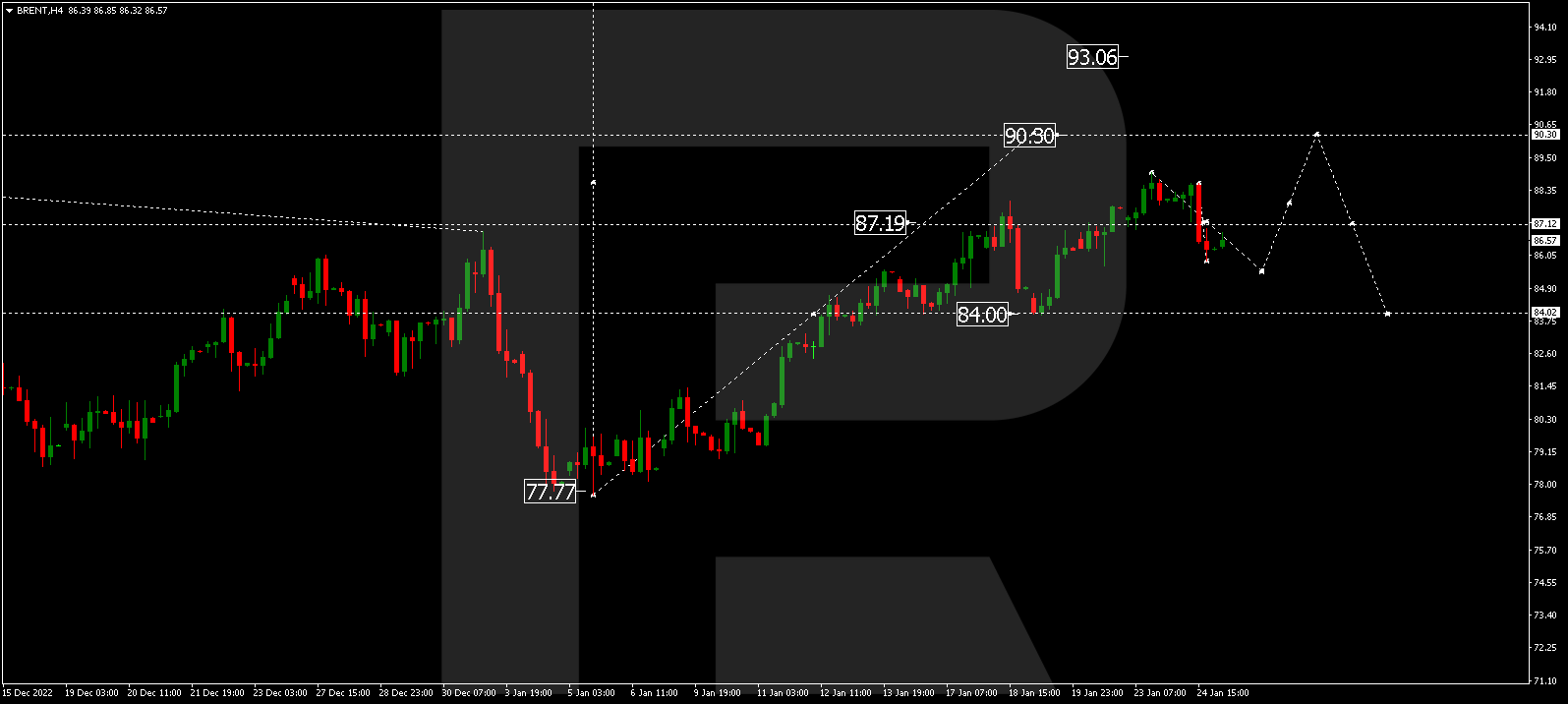

BRENT

Brent has performed a correction to 87.15. Another structure of decline to 85.45 might follow. Then the pair should grow to 90.30, from where the wave might extend to 93.00.

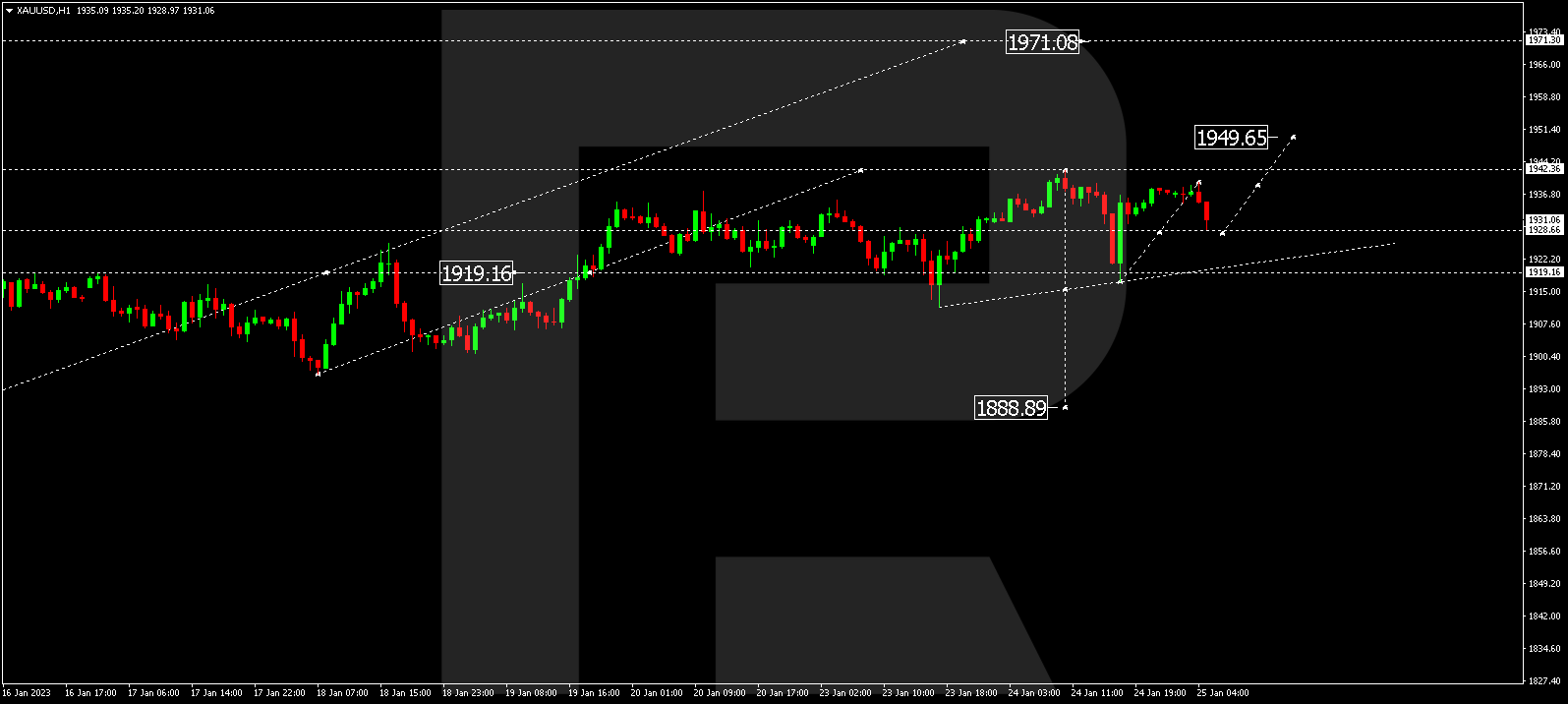

XAUUSD, “Gold vs US Dollar”

Gold has corrected to 1917.15 and has developed a link of growth to 1939.59. Today the market continues developing a structure of decline to 1928.33. Practically the market continues developing a consolidation range around this level. With an escape upwards, the price might grow to 1949.60. With an escape downwards, a pathway to 1888.88 should open.

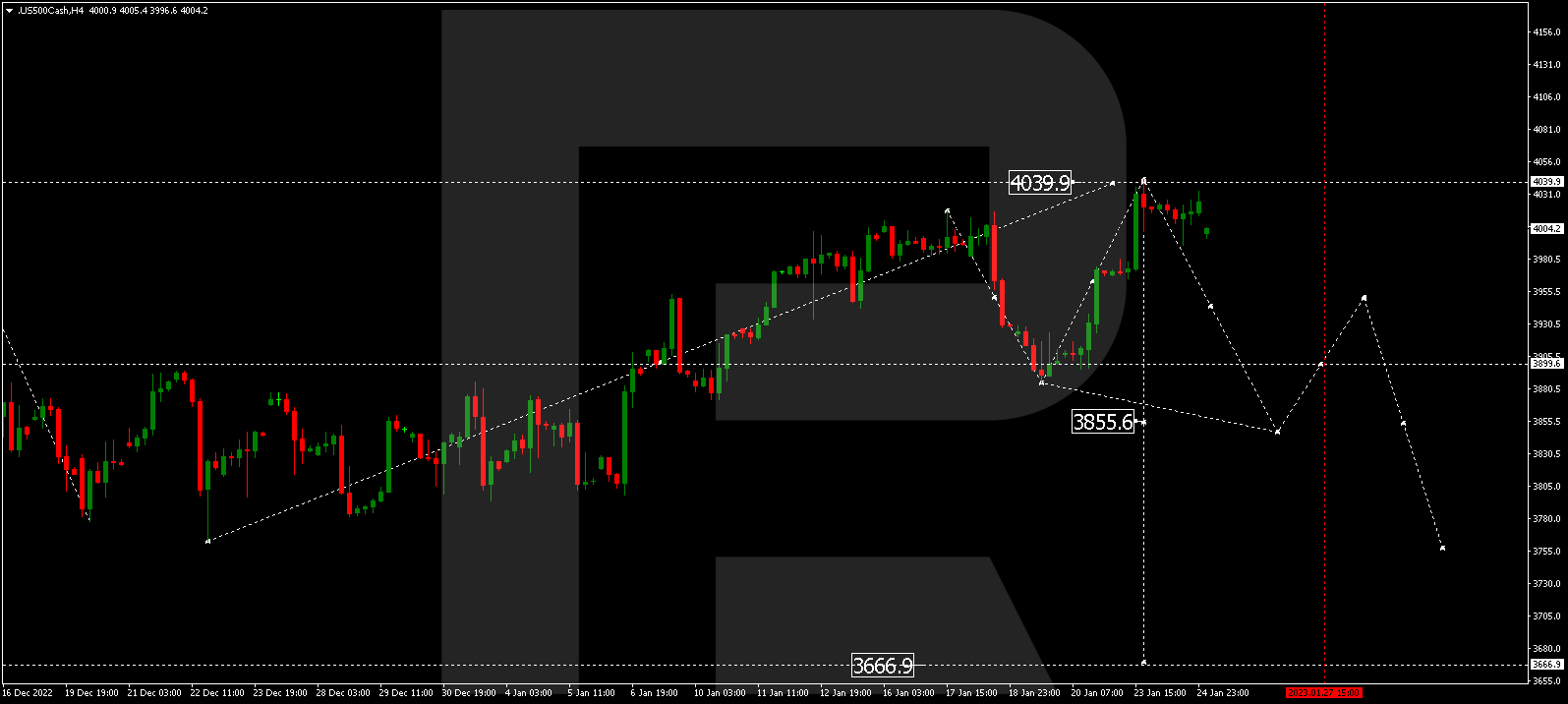

S&P 500

The stock index continues forming a consolidation range around 4000.0. With an escape upwards, a link of growth to 4050.0 is not excluded. With an escape downwards, a wave of decline to 3855.5 should start. The goal is first.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.