The Fed is committed to be more transparent. Fundamental analysis for 22.05.2014

22.05.2014

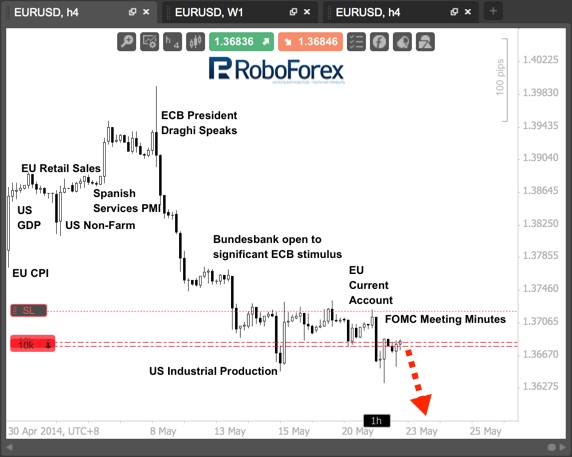

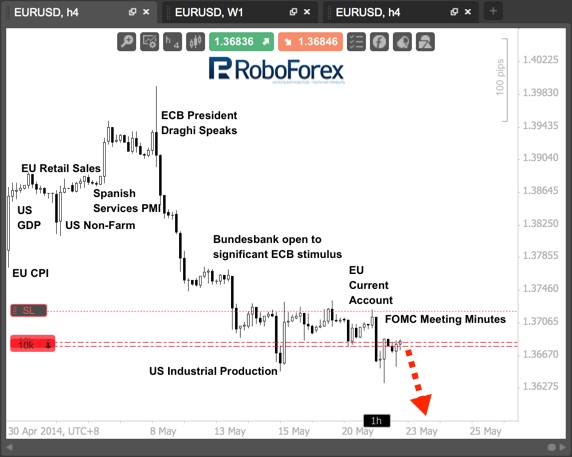

Yesterday's publication of the minutes of the last FOMC meeting pushed the Eurodollar to break through the minimum price. According to the text of the "minutes", many members of the Committee are pushing for more for more transparency - namely, to provide more detailed information on their plans for the shrink the balance of the Federal Reserve, which over the years of using incentive programs ballooned to $ 4 trillion.

Currently the regulator is reinvesting profits from repayable bonds, which supports the effect of rounds of quantitative easing. Accordingly, the rejection of these actions will lead to a gradual reduction in the balance, as well as weaken the stimulating effect on the economy. The implication is that the Fed can provide an estimated date and even the probable volume of reductions.

Moreover, specific economic triggers can be mentioned, such as the unemployment rate, which for quite a long time served as a benchmark for the rate increase, and only with the arrival of Janet Yellen was finally abolished. Also, some FOMC members expressed the need to determine the time to start raising rates after a stabilization of unemployment and inflation.

The Fed is in full agreement to be out of QE3. Monthly purchases of mortgage bonds and Treasury obligations have been reduced from $ 85 billion to $ 45 billion, while the regulator does not intend to stop. Most likely, the fall program will finally be archived, and then move to the question of raising the rate. That is why a number of FOMC members encourage their colleagues to quickly determine the deadline.

The determining factor in the decision on rates still remains the labour market, especially as announced earlier, that the Fed will consider the situation as a whole and not only unemployment. Despite strong enough statistics on jobs, many Americans continue to work part-time and the "long-term unemployed" in the majority still remain outside of the labour market.

I continue to sell the Eurodollar, and at the correction opened an additional trade as negative data for French PMI emerged. Both the service and industrial indicators fell below the critical level of 50, which means the reduction in and the probable return of recession in the Fifth Republic. The evening data on applications for unemployment benefits in the United States is expected to be strong, therefore there is every chance of a continuing down-trend.

RoboForex Analytical Department

Currently the regulator is reinvesting profits from repayable bonds, which supports the effect of rounds of quantitative easing. Accordingly, the rejection of these actions will lead to a gradual reduction in the balance, as well as weaken the stimulating effect on the economy. The implication is that the Fed can provide an estimated date and even the probable volume of reductions.

Moreover, specific economic triggers can be mentioned, such as the unemployment rate, which for quite a long time served as a benchmark for the rate increase, and only with the arrival of Janet Yellen was finally abolished. Also, some FOMC members expressed the need to determine the time to start raising rates after a stabilization of unemployment and inflation.

The Fed is in full agreement to be out of QE3. Monthly purchases of mortgage bonds and Treasury obligations have been reduced from $ 85 billion to $ 45 billion, while the regulator does not intend to stop. Most likely, the fall program will finally be archived, and then move to the question of raising the rate. That is why a number of FOMC members encourage their colleagues to quickly determine the deadline.

The determining factor in the decision on rates still remains the labour market, especially as announced earlier, that the Fed will consider the situation as a whole and not only unemployment. Despite strong enough statistics on jobs, many Americans continue to work part-time and the "long-term unemployed" in the majority still remain outside of the labour market.

I continue to sell the Eurodollar, and at the correction opened an additional trade as negative data for French PMI emerged. Both the service and industrial indicators fell below the critical level of 50, which means the reduction in and the probable return of recession in the Fifth Republic. The evening data on applications for unemployment benefits in the United States is expected to be strong, therefore there is every chance of a continuing down-trend.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.